| (単位 千円) |

| 年度別 | 調定済額 | 収入済額 | 徴収率 | ||||||

| 現年度分A | 滞納繰越分B | 合計C | 現年度分D | 滞納繰越分E | 合計F | D/A×100 | E/B×100 | F/C×100 | |

| 41 | 11,675 | 1,311 | 12,986 | 11,408 | 546 | 11,954 | 97.7 | 41.6 | 92.1 |

| 42 | 14,081 | 1,029 | 15,110 | 13,971 | 724 | 14,695 | 99.2 | 70.4 | 97.3 |

| 43 | 17,456 | 405 | 17,861 | 17,286 | 239 | 17,525 | 99.0 | 59.0 | 98.1 |

| 44 | 17,272 | 332 | 17,604 | 17,604 | 183 | 17,242 | 98.8 | 55.1 | 97.9 |

| 45 | 20,254 | 354 | 20,608 | 19,824 | 130 | 19,954 | 98.0 | 37.0 | 97.0 |

| 46 | 25,233 | 621 | 25,854 | 24,568 | 198 | 24,766 | 97.0 | 32.0 | 96.0 |

| 47 | 32,616 | 1,073 | 33,689 | 32,139 | 683 | 32,822 | 98.54 | 63.65 | 97.43 |

| 48 | 40,536 | 873 | 41,409 | 40,044 | 522 | 40,566 | 98.79 | 63.23 | 98.04 |

| 49 | 55,729 | 790 | 56,519 | 54,885 | 243 | 55,128 | 98.5 | 30.8 | 97.5 |

| 50 | 60,357 | 1,390 | 61,748 | 59,622 | 959 | 60,581 | 98.78 | 69.01 | 98.11 |

| 昭和51年度湯津上村一般会計歳入歳出決算書 |

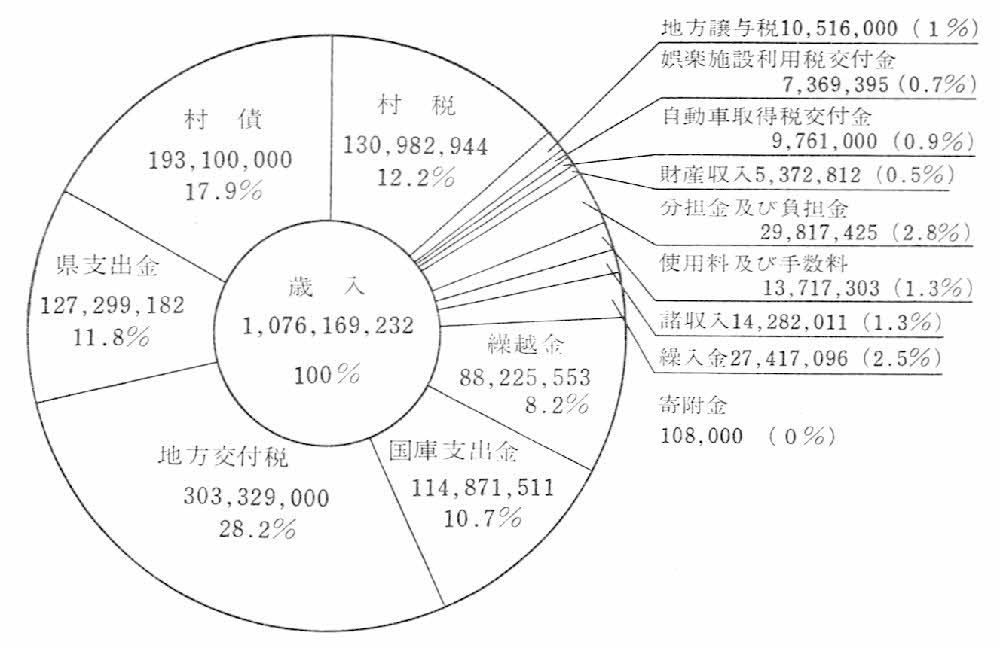

| 歳入 |

| (単位 円) |

| 款 | 項 | 予算現額 | 調定額 | 収入済額 | 不納欠損額 | 収入未済額 | 予算現額と収入済額との比較 |

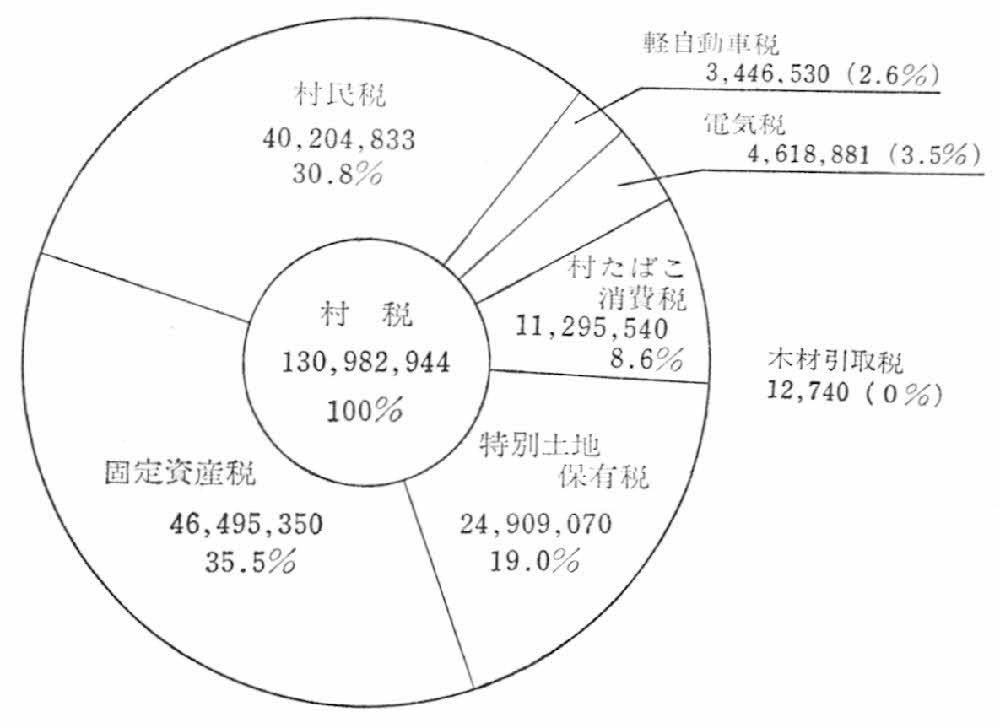

| 村税 | 116,054,000 | 145,582,351 | 130,982,944 | 14,599,407 | 14,928,944 | ||

| 村民税 | 30,140,000 | 40,373,980 | 40,204,833 | 169,147 | 10,064,833 | ||

| 固定資産税 | 44,500,000 | 47,418,900 | 46,495,350 | 923,550 | 1,995,350 | ||

| 軽自動車税 | 2,610,000 | 3,498,480 | 3,446,530 | 51,950 | 836,530 | ||

| 村たばこ消費税 | 11,000,000 | 11,295,540 | 11,295,540 | 295,540 | |||

| 電気税 | 4,000,000 | 4,618,881 | 4,618,881 | 618,881 | |||

| 木材引取税 | 1,000 | 12,740 | 12,740 | 11,740 | |||

| 特別土地保有税 | 23,803,000 | 38,363,830 | 24,909,070 | 13,454,760 | 1,106,070 | ||

| 地方譲与税 | 7,567,000 | 10,516,000 | 10,516,000 | 2,949,000 | |||

| 自動車重量譲与税 | 7,567,000 | 10,516,000 | 10,516,000 | 2,949,000 | |||

| 娯楽施設利用税交付金 | 1,000,000 | 7,369,395 | 7,369,395 | 6,369,395 | |||

| 娯楽施設利用税交付金 | 1,000,000 | 7,369,395 | 7,369,395 | 6,369,395 | |||

| 自動車取得税交付金 | 9,000,000 | 9,761,000 | 9,761,000 | 761,000 | |||

| 自動車取得税交付金 | 9,000,000 | 9,761,000 | 9,761,000 | 761,000 | |||

| 地方交付税 | 283,406,000 | 303,329,000 | 303,329,000 | 19,923,000 | |||

| 地方交付税 | 283,406,000 | 303,329,000 | 303,329,000 | 19,923,000 | |||

| 交通安全対策特別交付金 | 1,000 | △1,000 | |||||

| 交通安全対策特別交付金 | 1,000 | △1,000 | |||||

| 分担金及び負担金 | 60,016,000 | 63,251,425 | 29,817,425 | 33,434,000 | △30,198,575 | ||

| 分担金 | 59,952,000 | 63,190,000 | 29,756,000 | 33,434,000 | △30,196,000 | ||

| 負担金 | 64,000 | 61,425 | 61,425 | △2,575 | |||

| 使用料及び手数料 | 13,499,000 | 13,788,443 | 13,717,303 | 55,450 | 15,690 | 218,303 | |

| 使用料 | 12,559,000 | 12,582,553 | 12,511,413 | 55,450 | 15,690 | △47,587 | |

| 手数料 | 940,000 | 1,205,890 | 1,205,890 | 265,890 | |||

| 国庫支出金 | 112,916,000 | 114,871,511 | 14,871,511 | 1,955,511 | |||

| 国庫負担金 | 73,920,000 | 75,629,740 | 75,629,740 | 1,709,740 | |||

| 国庫補助金 | 35,224,000 | 34,954,995 | 34,954,995 | △269,005 | |||

| 委託金 | 3,772,000 | 4,286,776 | 4,286,776 | 514,776 | |||

| 県支出金 | 127,375,000 | 127,299,182 | 127,299,182 | △75,818 | |||

| 県負担金 | 6,670,000 | 6,772,345 | 6,772,345 | 102,345 | |||

| 県補助金 | 118,842,000 | 117,784,371 | 117,784,371 | △1,057,629 | |||

| 委託金 | 1,863,000 | 2,742,466 | 2,742,466 | 879,466 | |||

| 財産収入 | 752,000 | 5,372,812 | 5,372,812 | 4,620,812 | |||

| 財産運用収入 | 750,000 | 4,813,372 | 4,813,372 | 4,063,372 | |||

| 財産売却収入 | 2,000 | 559,440 | 559,440 | 557,440 | |||

| 寄附金 | 110,000 | 108,000 | 108,000 | △2,000 | |||

| 寄附金 | 110,000 | 108,000 | 108,000 | △2,000 | |||

| 繰入金 | 46,601,000 | 27,417,096 | 27,417,096 | △19,183,904 | |||

| 特別会計繰入金 | 1,000 | △1,000 | |||||

| 基金繰入金 | 46,600,000 | 27,417,096 | 27,417,096 | △19,182,904 | |||

| 繰越金 | 88,225,000 | 88,225,553 | 88,225,553 | 553 | |||

| 繰越金 | 88,225,000 | 88,225,553 | 88,225,553 | 553 | |||

| 諸収入 | 4,878,000 | 14,282,011 | 14,282,011 | 9,404,011 | |||

| 延滞金加算金及び過料 | 2,000 | 1,156,910 | 1,156,910 | 1,154,910 | |||

| 村預金利子 | 2,000,000 | 9,560,486 | 9,560,486 | 7,560,486 | |||

| 雑入 | 2,876,000 | 3,564,615 | 3,564,615 | 688,615 | |||

| 村債 | 193,100,000 | 193,100,000 | 193,100,000 | ||||

| 村債 | 193,100,000 | 193,100,000 | 193,100,000 | ||||

| 歳入合計 | 1,064,500,000 | 1,124,273,779 | 1,076,169,232 | 55,450 | 48,049,097 | 11,669,232 | |

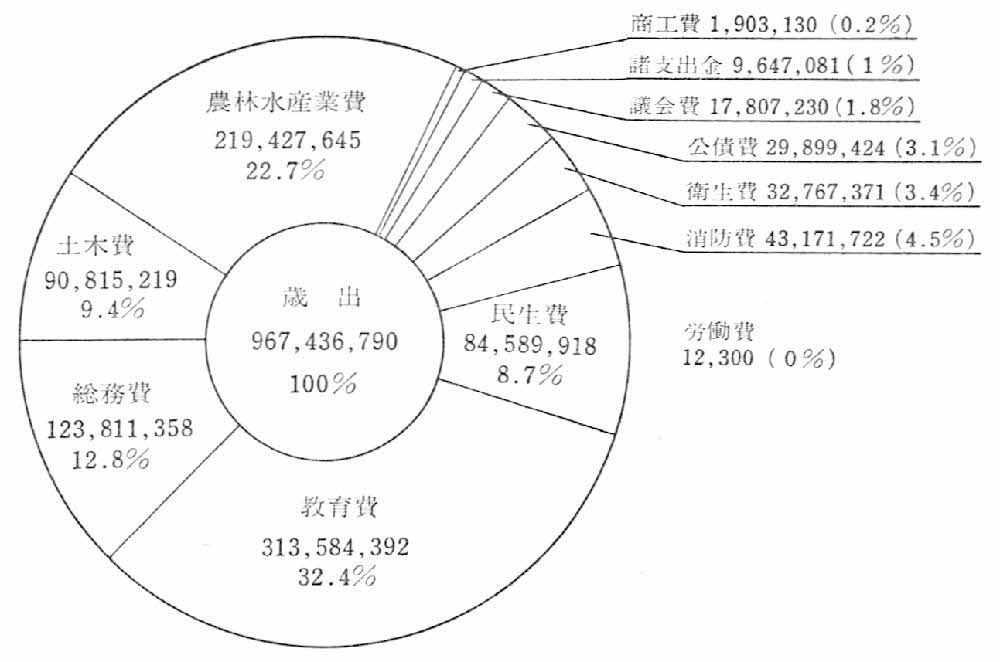

| 歳出 |

| (単位 円) |

| 款 | 項 | 予算現額 | 支出済額 | 翌年度繰越額 | 不用額 | 予算現額と支出済額との比較 |

| 議会費 | 17,832,095 | 17,807,230 | 24,865 | △24,865 | ||

| 議会費 | 17,832,095 | 17,807,230 | 24,865 | △24,865 | ||

| 総務費 | 127,353,021 | 123,811,358 | 3,541,663 | △3,541,663 | ||

| 総務管理費 | 98,576,454 | 95,765,499 | 2,810,955 | △2,810,955 | ||

| 徴税費 | 21,402,388 | 21,071,251 | 331,137 | △331,137 | ||

| 戸籍住民登録費 | 4,678,379 | 4,485,794 | 192,585 | △192,585 | ||

| 選挙費 | 2,211,800 | 2,028,564 | 183,236 | △183,236 | ||

| 統計調査費 | 271,000 | 250,490 | 20,510 | △20,510 | ||

| 監査委員費 | 213,000 | 209,760 | 3,240 | △3,240 | ||

| 民生費 | 87,508,525 | 84,589,918 | 2,918,607 | △2,918,607 | ||

| 社会福祉費 | 40,900,198 | 39,144,707 | 1,755,491 | △1,755,491 | ||

| 児童福祉費 | 46,608,327 | 45,445,211 | 1,163,116 | △1,163,116 | ||

| 衛生費 | 33,821,000 | 32,767,371 | 1,053,629 | △1,053,629 | ||

| 保健衛生費 | 33,821,000 | 32,767,371 | 1,053,629 | △1,053,629 | ||

| 労働費 | 29,000 | 12,300 | 16,700 | △16,700 | ||

| 失業対策費 | 1,000 | 1,000 | △1,000 | |||

| 労働諸費 | 28,000 | 12,300 | 15,700 | △15,700 | ||

| 農林水産業費 | 228,427,303 | 219,427,645 | 8,999,658 | △8,999,658 | ||

| 農業費 | 228,134,303 | 219,257,535 | 8,876,768 | △8,876,768 | ||

| 林業費 | 293,000 | 170,110 | 122,890 | △122,890 | ||

| 商工費 | 2,110,000 | 1,903,130 | 206,870 | △206,870 | ||

| 商工費 | 2,110,000 | 1,903,130 | 206,870 | △206,870 | ||

| 土木費 | 93,172,816 | 90,815,219 | 2,357,597 | △2,357,597 | ||

| 土木管理費 | 18,546,626 | 17,710,553 | 836,073 | △836,073 | ||

| 道路橋りょう費 | 74,232,190 | 72,766,516 | 1,465,674 | △1,465,674 | ||

| 河川費 | 394,000 | 338,150 | 55,850 | △55,850 | ||

| 消防費 | 43,958,050 | 43,171,722 | 786,328 | △786,328 | ||

| 消防費 | 43,958,050 | 43,171,722 | 786,328 | △786,328 | ||

| 教育費 | 319,066,808 | 313,584,392 | 5,482,416 | △5,482,416 | ||

| 教育総務費 | 21,228,084 | 19,948,037 | 1,280,047 | △1,280,047 | ||

| 小学校費 | 262,466,200 | 260,549,620 | 1,916,580 | △1,916,580 | ||

| 中学校費 | 14,485,704 | 13,675,796 | 809,908 | △809,908 | ||

| 幼稚園費 | 7,371,200 | 7,282,474 | 88,726 | △88,726 | ||

| 社会教育費 | 11,794,620 | 10,814,882 | 979,738 | △979,738 | ||

| 保健体育費 | 1,721,000 | 1,313,583 | 407,417 | △407,417 | ||

| 災害復旧費 | 1,000 | 1,000 | △1,000 | |||

| 農林水産施設災害復旧費 | 1,000 | 1,000 | △1,000 | |||

| 公債費 | 29,935,000 | 29,899,424 | 35,576 | △35,576 | ||

| 公債費 | 29,935,000 | 29,899,424 | 35,576 | △35,576 | ||

| 諸支出金 | 9,649,000 | 9,647,081 | 1,919 | △1,919 | ||

| 普通財産取得費 | 9,649,000 | 9,647,081 | 1,919 | △1,919 | ||

| 予備費 | 71,636,382 | 71,636,382 | △71,636,382 | |||

| 予備費 | 71,636,382 | 71,636,382 | △71,636,382 | |||

| 歳出合計 | 1,064,500,000 | 967,436,790 | 97,063,210 | △97,063,210 | ||

| 歳入歳出差引残高 108,732,442円 | ||||||

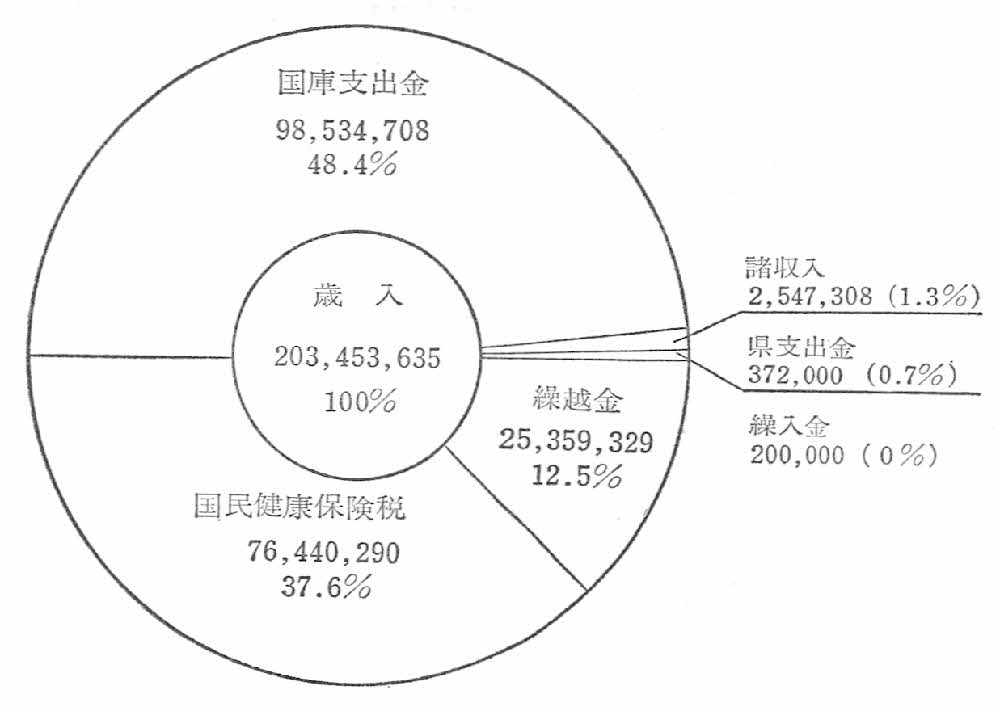

| 昭和51年度湯津上村国民健康保険特別会計歳入歳出決算書 歳入 |

| (単位 円) |

| 款 | 項 | 予算現額 | 調定額 | 収入済額 | 不納欠損額 | 収入未済額 | 予算現額と収入済額との比較 |

| 国民健康保険税 | 77,464,000 | 78,100,240 | 76,440,290 | 42,440 | 1,617,510 | △1,023,710 | |

| 国民健康保険税 | 77,464,000 | 78,100,240 | 76,440,290 | 42,440 | 1,617,510 | △1,023,710 | |

| 一部負担金 | 1,000 | △1,000 | |||||

| 一部負担金 | 1,000 | △1,000 | |||||

| 使用料及び手数料 | 1,000 | △1,000 | |||||

| 手数料 | 1,000 | △1,000 | |||||

| 国庫支出金 | 103,731,000 | 98,534,708 | 98,534,708 | △5,196,292 | |||

| 国庫負担金 | 94,648,000 | 85,998,708 | 85,998,708 | △8,649,292 | |||

| 国庫補助金 | 9,083,000 | 12,536,000 | 12,536,000 | 3,453,000 | |||

| 県支出金 | 1,000 | 372,000 | 372,000 | 371,000 | |||

| 県補助金 | 1,000 | 372,000 | 372,000 | 371,000 | |||

| 財産収入 | 1,000 | △1,000 | |||||

| 財産収入 | 1,000 | △1,000 | |||||

| 寄附金 | 1,000 | △1,000 | |||||

| 寄附金 | 1,000 | △1,000 | |||||

| 繰入金 | 200,000 | 200,000 | 200,000 | ||||

| 他会計繰入金 | 200,000 | 200,000 | 200,000 | ||||

| 繰越金 | 25,359,000 | 25,359,329 | 25,359,329 | 329 | |||

| 繰越金 | 25,359,000 | 25,359,329 | 25,359,329 | 329 | |||

| 諸収入 | 100,000 | 2,547,308 | 2,547,308 | 2,447,308 | |||

| 延滞金,加算金及び過料 | 2,000 | △2,000 | |||||

| 村預金利子 | 1,000 | △1,000 | |||||

| 雑入 | 97,000 | 2,547,308 | 2,547,308 | 2,547,308 | |||

| 歳入合計 | 206,859,000 | 205,113,585 | 203,453,635 | 42,440 | 1,617,510 | △3,405,365 | |

| 歳出 |

| (単位 円) |

| 款 | 項 | 予算現額 | 支出済額 | 翌年度繰越額 | 不用額 | 予算現額と支出済額との比較 |

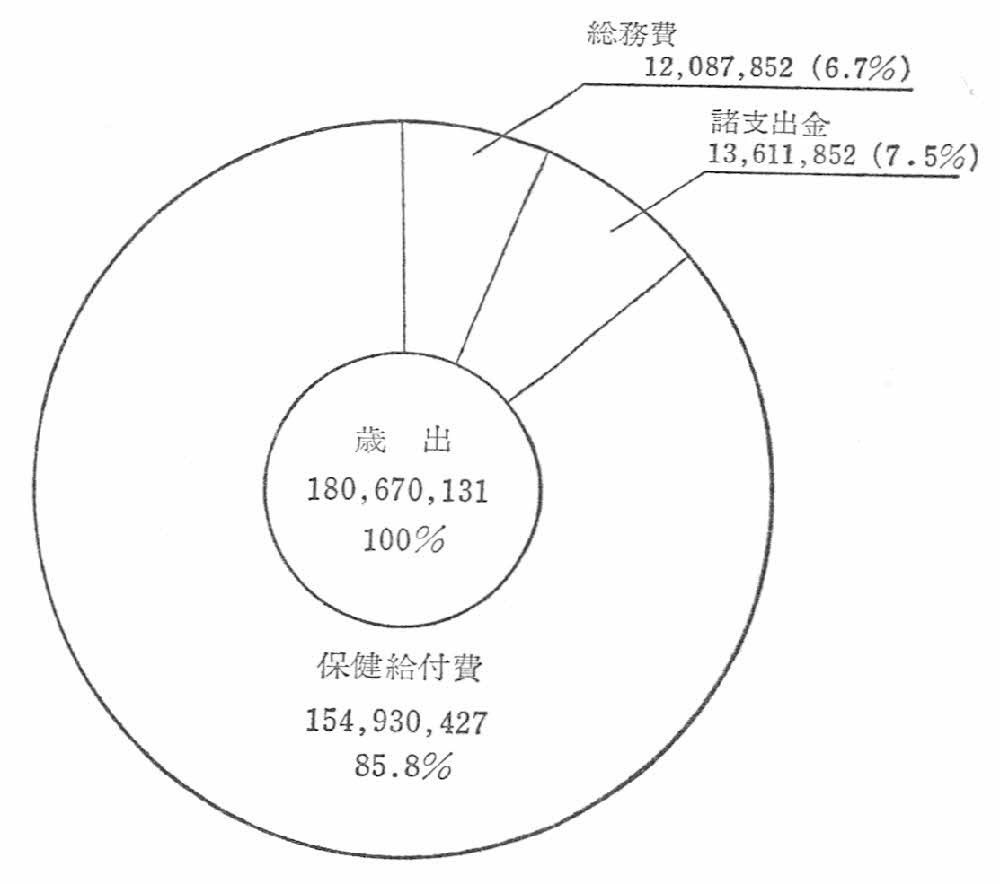

| 総務費 | 12,376,200 | 12,087,852 | 288,348 | △288,348 | ||

| 総務管理費 | 9,425,670 | 9,287,237 | 138,433 | △138,433 | ||

| 徴税費 | 2,690,530 | 2,562,295 | 128,235 | △128,235 | ||

| 運営協議会費 | 260,000 | 238,320 | 21,680 | △21,680 | ||

| 保険給付費 | 171,058,000 | 154,930,427 | 16,127,573 | △16,127,573 | ||

| 療養諸費 | 162,141,593 | 146,242,020 | 15,899,573 | △15,899,573 | ||

| 高額療養費 | 6,229,407 | 6,229,407 | ||||

| 助産諸費 | 2,200,000 | 2,040,000 | 160,000 | △160,000 | ||

| 葬祭費 | 322,000 | 266,000 | 56,000 | △56,000 | ||

| 育児諸費 | 165,000 | 153,000 | 12,000 | △12,000 | ||

| 保健施設費 | 1,728,000 | 1,728,000 | △1,728,000 | |||

| 保健施設費 | 1,728,000 | 1,728,000 | △1,728,000 | |||

| 諸支出金 | 13,613,200 | 13,611,852 | 1,348 | △1,348 | ||

| 償還金及び還付加算金 | 1,613,200 | 1,611,852 | 1,348 | △1,348 | ||

| 基金積立金 | 12,000,000 | 12,000,000 | ||||

| 予備費 | 8,083,600 | 8,083,600 | △8,083,600 | |||

| 予備費 | 8,083,600 | 8,083,600 | △8,083,600 | |||

| 歳出合計 | 206,859,000 | 180,630,131 | 26,228,869 | △26,228,869 | ||

| 歳入歳出差引残高 22,823,504円 | ||||||

国民健康保険特別会計

| 実質収支に関する調書 1 一般会計 |

| (単位 円) |

| 区分 | 金額 | |

| 歳入総額 | 1,076,169,232 | |

| 歳出総額 | 967,436,790 | |

| 歳入歳出差引額 | 108,732,442 | |

| 翌年度へ繰越すべき財源 | 継続費逓次繰越額 | 0 |

| 繰越明許費繰越額 | 0 | |

| 事故繰越繰越額 | 0 | |

| 計 | 0 | |

| 実質収支額 | 108,732,442 | |

| 実質収支額の内地方自治法第233条の2の規定による基金繰入額 | 0 | |

| 2 国民健康保険特別会計 |

| (単位 円) |

| 区分 | 金額 | |

| 歳入総額 | 203,453,635 | |

| 歳出総額 | 180,630,131 | |

| 歳入歳出差引額 | 22,823,504 | |

| 翌年度へ繰越すべき財源 | 継続費逓次繰越額 | 0 |

| 繰越明許費繰越額 | 0 | |

| 事故繰越繰越額 | 0 | |

| 計 | 0 | |

| 実質収支額 | 22,823,504 | |

| 実質収支額の内地方自治法第233条の2の規定による基金繰入額 | 0 | |

| 1.一般会計 昭和51年度村税徴収実績 |

| 区分 | 徴収決定済額(円) | 徴収済額(円) | ||||

| 現年度分A | 滞納繰越分B | 合計C | 現年度分D | 滞納繰越分E | 合計F | |

| 村民税 | 40,180,749 | 193,231 | 40,373,980 | 40,062,042 | 142,791 | 40,204,833 |

| 個人 | 36,792,439 | 143,191 | 36,935,630 | 36,686,732 | 92,751 | 36,779,483 |

| 法人 | 3,388,310 | 50,040 | 3,438,350 | 3,375,310 | 50,040 | 3,425,350 |

| 固定資産税 | 47,181,570 | 237,330 | 47,418,900 | 46,290,080 | 205,270 | 46,495,350 |

| 固定資産税 | 46,895,460 | 237,330 | 47,132,790 | 46,003,970 | 205,270 | 46,209,240 |

| 交付金納付金 | 286,110 | 286,110 | 286,110 | 286,110 | ||

| 軽自動車税 | 3,439,530 | 58,950 | 3,498,480 | 3,398,790 | 47,740 | 3,446,530 |

| たばこ消費税 | 11,295,540 | 11,295,540 | 11,295,540 | 11,295,540 | ||

| 電気税 | 4,618,881 | 4,618,881 | 4,618,881 | 4,618,881 | ||

| 木材引取税 | 12,740 | 12,740 | 12,740 | 12,740 | ||

| 特別土地保有税 | 32,375,380 | 38,363,830 | 18,920,620 | 5,988,450 | 24,909,070 | |

| 合計 | 139,104,390 | 5,988,450 | 145,582,351 | 124,598,693 | 6,384,251 | 130,982,944 |

| 区分 | 徴収率(%) | ||

| 現年度D/A | 滞納繰越分E/B | 合計F/C | |

| 村民税 | 99.70 | 73.89 | 99.58 |

| 個人 | 99.71 | 64.77 | 99.57 |

| 法人 | 99.61 | 100.00 | 99.62 |

| 固定資産税 | 98.11 | 86.49 | 98.05 |

| 固定資産税 | 98.09 | 86.49 | 98.04 |

| 交付金納付金 | 100.00 | 100.00 | |

| 軽自動車税 | 98.81 | 80.98 | 98.51 |

| たばこ消費税 | 100.00 | 100.00 | |

| 電気税 | 100.00 | 100.00 | |

| 木材引取税 | 100.00 | 100.00 | |

| 特別土地保有税 | 58.44 | 100.00 | 64.92 |

| 合計 | 89.57 | 64.92 | 89.97 |

| 2.特別会計 昭和51年度国民健康保険税徴収実績 |

| 区分 | 徴収決定済額(円) | 徴収済額(円) | 徴収率(%) | ||||||

| 現年度分A | 滞納繰越分B | 合計C | 現年度分D | 滞納繰越分E | 合計F | 現年度分 D/A | 滞納繰越分 E/B | 合計F/C | |

| 国民健康保険税 | 76,938,940 | 1,161,300 | 78,100,240 | 75,921,880 | 518,410 | 76,440,290 | 98.67 | 44.64 | 97.87 |

一般会計(単位 円)

国保特別会計